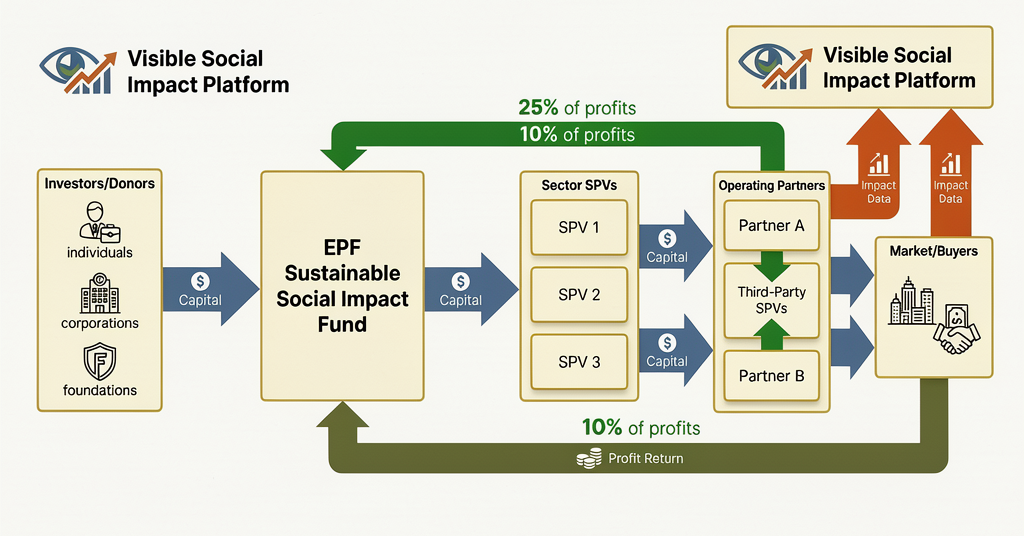

EPF SSIF

EPF SSIF

Turning Social Impact

Into An Investable Asset

A new model for scaling youth employment and enterprise in South Africa. Moving from dependency to digital resilience and economic sovereignty.